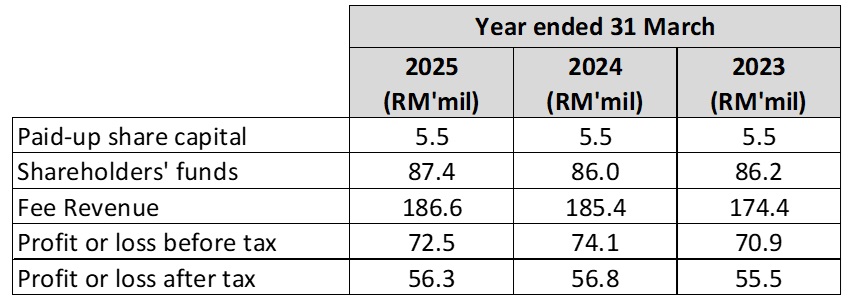

AmFunds Management Berhad

AmFunds Management Berhad (“AFM”) – Registration No. 198601005272 (154432-A) was incorporated in Malaysia on 9 July 1986 and is a licensed fund manager approved by the Securities Commission Malaysia (“SC”) on 25 September 2008. AFM is a wholly-owned subsidiary of AmInvestment Bank Berhad. AmInvest is the brand name for AFM.

AFM is a holder of Capital Markets and Services Licence pursuant to the Capital Markets and Services Act 2007 for the regulated activities of fund management in relation to portfolio management, dealing in securities restricted to unit trusts and dealing in private retirement schemes. AFM offers a diverse range of both conventional and Shariah-compliant retirement funds across asset classes and geographical exposures in the market. AFM also manages exchange-traded funds (ETFs).

AFM has appointed AmIslamic Funds Management Sdn. Bhd. (AIFM), a licensed fund manager approved by the Securities Commission Malaysia (“SC”) on 12 January 2009, to implement its Shariah-compliant funds’ investment strategies to achieve the objectives of its funds.

As at Financial Year End 2025 (31 March 2025), AFM is not involved in any material litigation and arbitration, including those pending or threatened, and any facts likely to give rise to any proceedings which might materially affect the business or financial position of AFM.

22nd Floor, Bangunan AmBank Group,

55, Jalan Raja Chulan, 50200 Kuala Lumpur

Tel: (03) 2036 2633

Email: [email protected]

Website Address: www.aminvest.com

9th & 10th Floor, Bangunan AmBank Group,

55, Jalan Raja Chulan, 50200 Kuala Lumpur

Tel: (03) 2032 2888

Email: [email protected]

Website Address: www.aminvest.com

More information on AmFunds Management Berhad

*Excludes the AUM and funds delegated to AIFM.

Notwithstanding, cross trades between the personal account of an employee of the Manager and the fund's account are strictly prohibited. The execution of cross trade (if any) will be reported to the Investment Committee and disclosed in the fund's report accordingly.

Key Personnel

Diverse and Dedicated Team of Fund Management Specialists

Kevin Wong Weng Tuck

Wong Yew Joe

J Visvanathan Jaganatha Thevar

Yasotha Kandasamy

Jasmine Ooi Hui Khim

Valerie Low Lai Kin

The Board of Directors

Mdm Jas Bir Kaur A/P Lol Singh

Chairman, Independent

Mr Ng Chih Kaye

Independent

Mr Lim Kheng Swee, Ronnie

Independent

Mr Kevin Wong Weng Tuck

Non-Independent

The Investment Committee

Mr Jeroen Thijs

Chairman

Ms Goh Wee Peng

Mr Kevin Wong Weng Tuck

Mr Mirza Shah Bin Abdul Rahim Shah

Designated Fund Manager