About AmInvest

Solutions for a Changing World

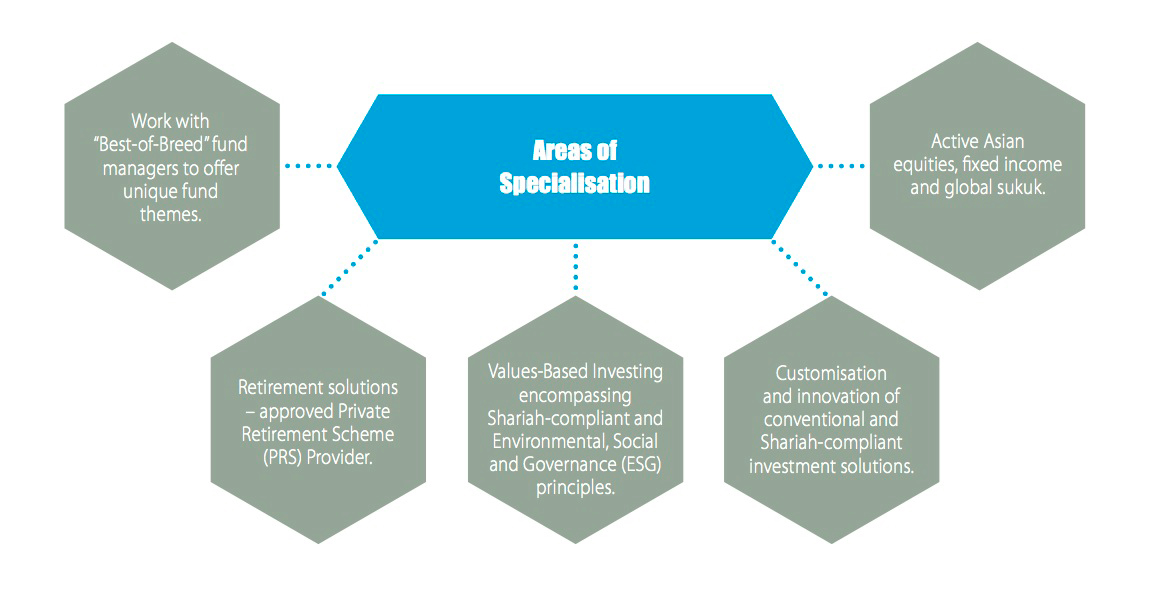

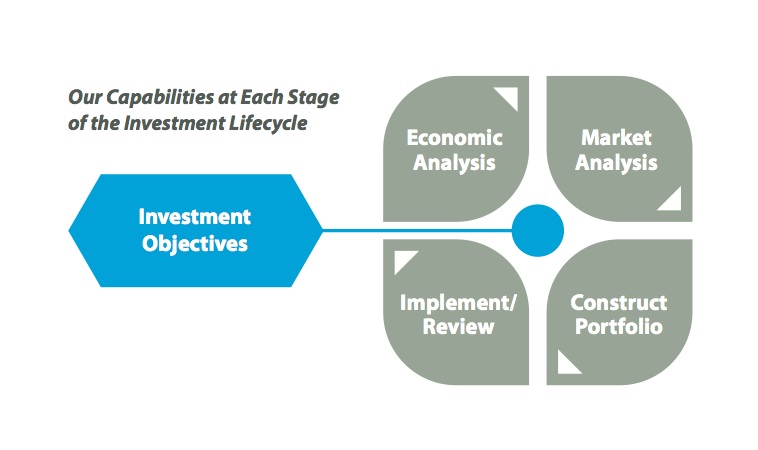

Our capabilities and expertise encompass offering and managing a broad range of funds across the whole risk-return spectrum for individuals, corporates and institutions as well as fund distribution support services for distributors.

Partnering you to grow your investment in a changing world

Pioneering Innovation

- Our innovative spirit has led to a series of “first-to-market” products across asset classes as well as services.

Retirement Solutions to Help You Live Your Retirement Dreams

- We are an approved PRS Provider with a range of retirement solutions across asset classes and geographical exposure that investors can choose from based on their retirement needs, goals and risk appetite.

Values-based Investing

- We create and manage funds that align your personal or institutional beliefs with investing. We have funds that take into account Shariah-compliant and Environmental, Social and Governance (ESG) principles in our investment decision making. We also have the expertise and know-how to customise investment solutions to accommodate different investors’ Shariah-compliant frameworks.

Recognised Expertise

- Our fund management expertise is backed by an award-winning track record.

Diverse and Experienced Team of Investment Professionals

- Multidisciplinary teams across different areas of specialisations that bring the best practices of funds management.

Expertise in Managing Performance and Risk

Innovation

Heritage of Pioneering First-to-Market Innovative Solutions

= Conventional Investing

= Conventional Investing = Values-Based Investing

= Values-Based Investing| Innovations | Year |

| Malaysia’s FIRST Robotech fund1 (Robotech Fund) | 2018 |

| Malaysia’s FIRST PRS REITs offering2 (AmPRS - Asia Pacific REITs) | 2014 |

| Malaysia’s FIRST PRS bond offerings2 (AmPRS Dynamic# Sukuk) (AmPRS - Tactical Bond) | 2013 |

| Malaysia’s FIRST USD Based Global Sukuk fund4 (AmGlobal Sukuk) | 2012 |

| Malaysia’s FIRST property fund that solely invests in REITs3 (AmAsia Pacific REITs) | 2011 |

| World’s FIRST Shariah-compliant ASEAN equity fund5 (AmASEAN Equity) | 2011 |

| Malaysia’s FIRST multi-currency fund that invests in Greater China4 (AmIslamic Greater China) | 2010 |

| Malaysia’s FIRST open ended fund that focuses its investments in Brazil, Russia, India and China (BRIC)3 (AmBRIC Equity) | 2009 |

| Malaysia’s FIRST USD based Asia-Pacific ex-Japan Shariah Compliant equity master/feeder fund4 (AmNamaa’ / Namaa’ Asia-Pacific Equity Growth) | 2008 |

| Malaysia’s FIRST Emerging market bond fund2 (AmEmerging Markets Bond) | 2008 |

| Malaysia's FIRST equity fund that invests in Gold and other precious metals4 (Precious Metals Securities) | 2007 |

| Malaysia's FIRST

equity exchange-traded fund (ETF)3 (FBM KLCI etf-formerly known as FBM30etf) | 2007 |

| Malaysia's FIRST equity fund that invests in food supply chain3 (Global Agribusiness) | 2007 |

| Malaysia's FIRST European property equity fund3 (AmPan European Property Equities) | 2007 |

| Malaysia's FIRST Asian bond fund3 (AmAsian Income) | 2006 |

| Malaysia's FIRST European equity fund3 (AmSchroders European Equity Alpha) | 2006 |

| Malaysia's FIRST Asia-Pacific property fund3 (AmAsia-Pacific Property Equities) | 2006 |

| Malaysia's FIRST

global Shariah-compliant equity fund4 (AmOasis Global Islamic Equity) | 2006 |

| FiRST global property fund3 (AmGlobal Property Equities Fund) | 2005 |

| Malaysia’s FIRST bond ETF3 (ABF Malaysian Bond Index Fund) | 2005 |

| Malaysia’s FIRST Shariah-compliant facility for corporate treasury requirements4 (Islamic Treasury Solution) | 2001 |

| Malaysia’s FIRST Shariah-compliant facility compromising a complete group of asset classes4 (Al-Syamil® Facility) | 2001 |

| Malaysia’s FIRST Shariah-compliant money market fund4 (AmAl-Amin) | 2001 |

| Malaysia’s FIRST facility for corporate treasury requirements3 (Treasury Solution™ Facility) | 2000 |

| Malaysia’s FIRST Shariah-compliant equity fund based on Mudharabah structure (profit sharing)4 (AmIttikal) | 1993 |

| Malaysia’s FIRST money market fund6 (AmCash Management) | 1986 |

Sources:

1. Based on data compiled by Lipper, a Thomson Reuters company, on the funds launched on or before 27 July 2018 in Malaysia. The list of funds was filtered according to the criteria comprising Active Primary Funds; Domicile: Malaysia; Asset Universe: mutual funds, pension funds and ETFs. The list of funds was searched for keywords that contain the words "technology", "robot", "robotic" and "robotech".

2. Lipper for Investment Management, by Lipper a Thomson Reuters company based on the fund's launch date under Global Classification: Bond Global (AmPRS-Dynamic Sukuk D), Bond Asia Pacific (AmPRS-Tactical Bond D) and Equity Sector Real Estate Asia Pacific (AmPRS-Asia Pacific REITS D). Data extracted 4 January 2018.

3. Lipper for Investment Management by Lipper, a Thomson Reuters company based on the fund's launch date, data extracted as at 30 September 2016.

4. Lipper for Investment Management by Lipper, a Thomson Reuters company based on the fund's launch date, data extracted as at 13 September 2016.

5. Lipper for Investment Management by Lipper, a Thomson Reuters company, data extracted as at 4 August 2016. The list of funds were filtered using the following criteria: Active Primary Equity ASEAN Islamic Mutual funds and based on its launch date.

6. Lipper for Investment Management by Lipper, a Thomson Reuters company based on the fund's launch date under Global Classification: Money Market, data extracted as at 30 September 2016.

#The word "Dynamic" in this context refers to the Fund's investment strategy which is active management, not buy-and-hold strategy.

Learn More About AmInvest