Introduction to Unit Trust

What is a unit trust fund?

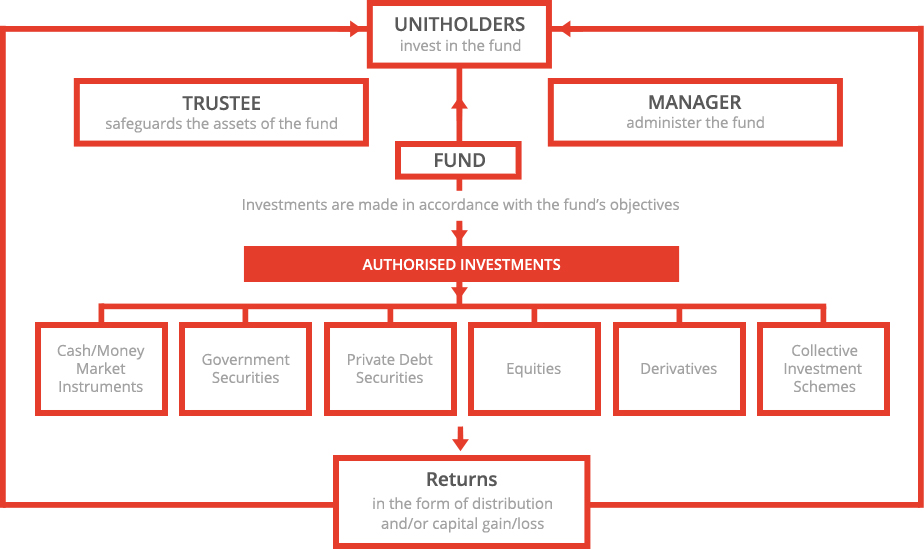

A unit trust fund is a vehicle which enables individuals, corporations and institutions that have common investment objectives to pool their money. Professional fund managers then use this pooled money to acquire investments they consider will help meet those objectives. These investments are collectively referred to as the fund's assets. As a safeguard for investors, the manager is not allowed to hold the fund's assets in its own name. Instead, a trustee is appointed to act as custodian of the assets.

In summary, a unit trust fund is a three-way relationship between:

- a unitholder - who invests money in the fund by buying units.

- a trustee - who is required to use due care in protecting the unitholders' rights and interests. The fund's assets are held by the trustee and the trustee receives all income from those assets.

- a manager - who is responsible for setting and implementing the investment strategy and is also responsible for the proper administration of the fund.

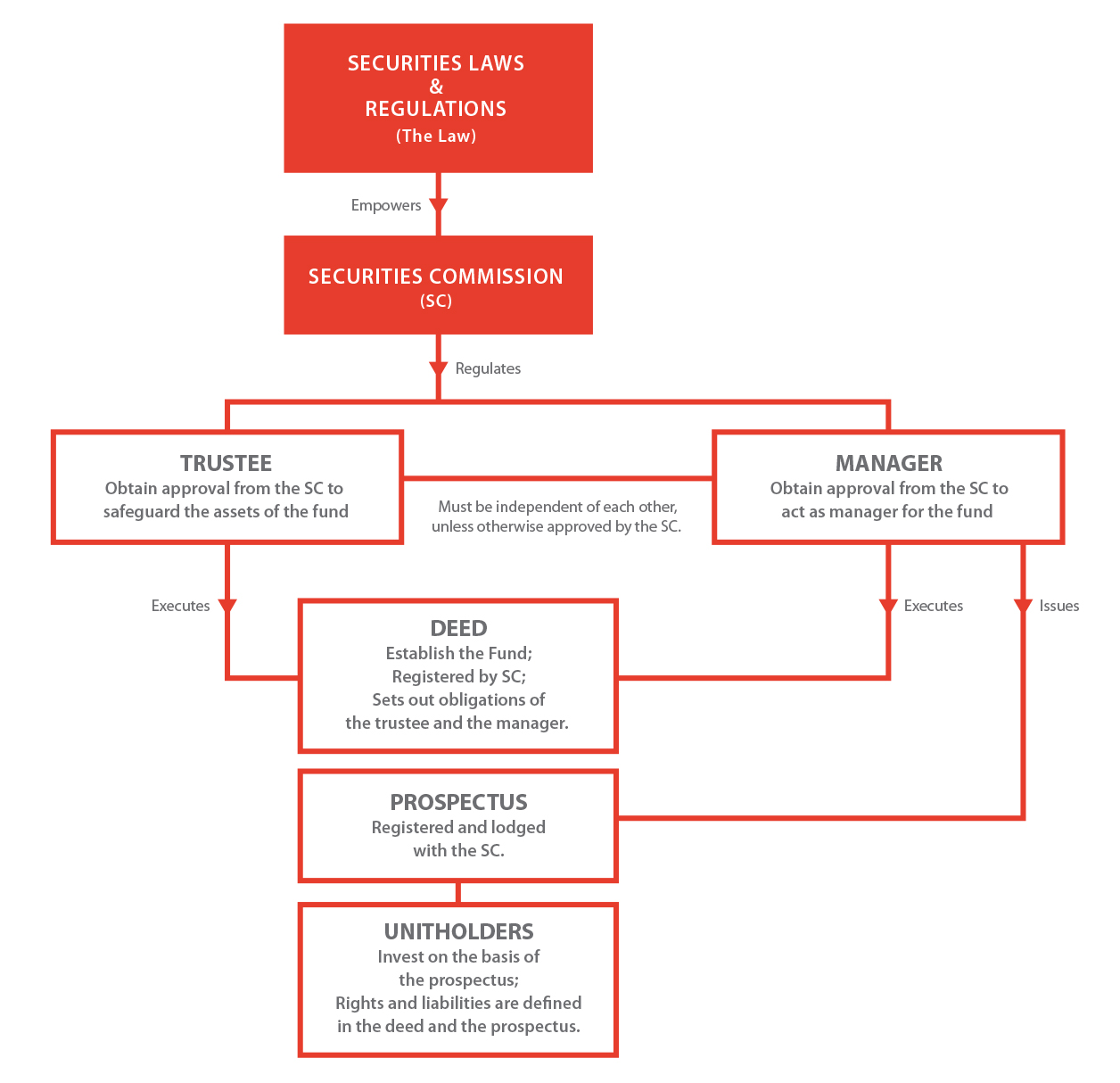

How are unit trusts being regulated in Malaysia?

How to be wary of unlicensed investment schemes in the market?